DOGE Price Prediction: Technical Consolidation Meets Bullish Fundamentals

#DOGE

- Technical Positioning: DOGE trades below key moving averages but shows early bullish divergence in momentum indicators

- Fundamental Catalysts: Whale accumulation, ETF speculation, and regulatory developments provide strong upside potential

- Risk Assessment: High volatility asset requiring careful position sizing and stop-loss management

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Amid Consolidation

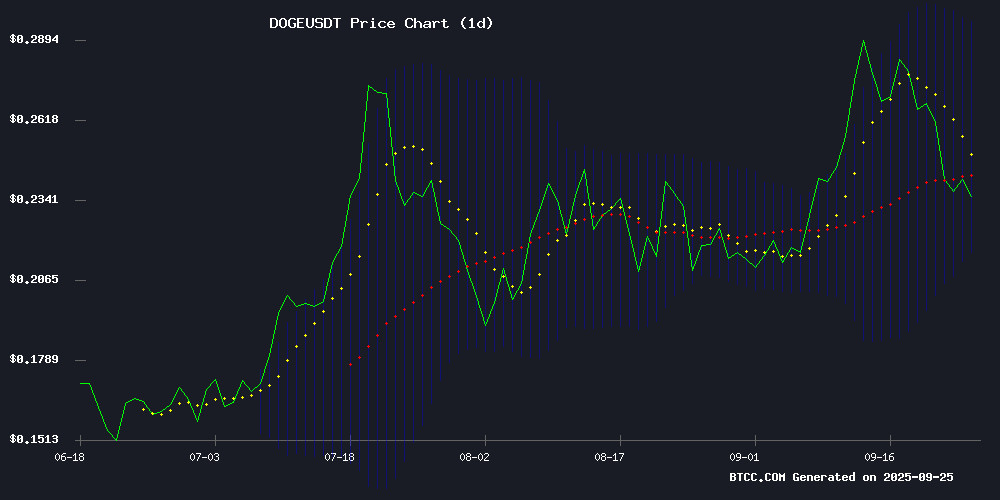

According to BTCC financial analyst Ava, Dogecoin currently trades at $0.23356, below its 20-day moving average of $0.255858, indicating short-term bearish pressure. The MACD indicator shows a slight bullish divergence with the histogram at 0.007448, suggesting potential momentum shift. However, DOGE remains trapped between Bollinger Band support at $0.215898 and resistance at $0.295817, requiring a breakout for directional clarity.

Market Sentiment: Bullish Catalysts Counter Technical Weakness

BTCC financial analyst Ava notes that despite technical struggles, fundamental catalysts are building. Whale accumulation of 2 billion DOGE, ETF speculation, and regulatory tailwinds create positive sentiment. The $3 rally speculation and 195% price predictions reflect growing institutional interest, though Ava cautions that technical resistance levels must be breached for sustained upward movement.

Factors Influencing DOGE's Price

Dogecoin Price Prediction Sparks Debate Amid $3 Rally Speculation

Dogecoin's potential to reach $3 has divided analysts, with some citing its cultural resilience and others questioning its capacity for another explosive rally. The meme coin's enduring social media presence and exchange liquidity make it a bellwether for retail sentiment, but its market cap growth may limit upside surprises.

Emerging tokens like Layer Brett are drawing attention as alternative high-risk plays, reflecting a broader market shift toward speculative assets. Dogecoin's 2025 prospects hinge on whether it can replicate past momentum cycles despite increased competition in the meme coin sector.

DOGE Price Poised for 195% Rally as Whale Activity Soars and ETF Odds Climb

Dogecoin (DOGE) is capturing market attention with a potential 195% surge, as analysts point to historical patterns and heightened whale activity. Over 2 billion DOGE were snapped up in 24 hours, signaling aggressive accumulation during the recent market dip.

Technical analyst Javon Marks highlights a bullish setup mirroring past rallies, projecting a minimum target of $0.73905—a level that would shatter DOGE's previous all-time high. The meme coin's consolidation near the $0.244 resistance level now serves as a springboard for the anticipated breakout.

Market sentiment receives an additional boost from near-certain ETF prospects. With a 99% approval probability for a spot Dogecoin ETF, institutional interest appears to be converging with retail frenzy. This convergence mirrors the dynamics seen during Bitcoin's ETF-driven rallies, suggesting DOGE may be poised for a similar trajectory.

Dogecoin Surges as Whales Accumulate 2 Billion DOGE Amid ETF Speculation

Dogecoin (DOGE) has demonstrated notable resilience following a market correction, with whale activity driving significant accumulation. Over 2 billion DOGE were purchased within 48 hours, fueling analyst predictions of a potential 195% to 800% price surge. The memecoin's stability within the $0.236–$0.244 range suggests consolidation before a potential breakout.

Cryptocurrency analyst Javon Marks projects a rally past $0.73905, citing historical patterns, while pseudonymous trader Bitcoin Consensus identifies an ascending trendline supporting an $1.30 target. Market observers note parallels to previous cycles where DOGE rallied 300%-500%.

Speculation around potential Dogecoin ETF developments adds momentum, though no formal filings have been confirmed. The absence of exchange-specific activity in this accumulation phase suggests broad-based institutional interest rather than platform-driven trading.

Dogecoin Struggles to Hold Key Support Amid Bearish Technicals

Dogecoin's price action reflects growing bearish momentum as the meme coin fails to sustain critical levels. The asset has slumped below the psychologically important $0.25 threshold, now testing support near $0.23. Market structure appears weak with DOGE trading below both its descending trendline and key moving averages.

Technical indicators show limited buying interest, with resistance firmly established at $0.245. The $0.28-$0.30 zone now represents a crucial battleground—any sustained move above this range could signal trend reversal. Until then, the path of least resistance points downward, with stronger support waiting near $0.20.

Dogecoin Struggles Below Key Resistance as SpacePay Targets Utility Gap

Dogecoin remains trapped below the $0.35 resistance level, a technical barrier that has stifled multiple rally attempts. The memecoin's persistent stagnation underscores a broader market reality: social media hype alone cannot sustain valuations without real-world utility.

SpacePay emerges as a potential solution, addressing DOGE's fundamental adoption challenge through instant settlement features. Where technical analysis fails, practical spending applications may succeed in creating the organic demand needed for price discovery.

Chart patterns continue signaling bullish potential, but resistance at $0.35 reveals deeper market skepticism. Until transaction volumes reflect substantive commerce rather than speculative trading, DOGE may remain range-bound despite its passionate community.

DOGE Price Prediction: Dogecoin Whales Accumulation Signals Trend Reversal

Dogecoin (DOGE) shows signs of a potential trend reversal as whale accumulation and technical patterns suggest bullish momentum. The memecoin gained 2% in the past 24 hours, peaking at $0.2497 before settling at $0.2429. With a market cap of $36.8 billion, DOGE remains a key player in the crypto market.

Technical analysis reveals a rising wedge pattern forming since early April 2025. A recent retest of the lower border at 23 cents—following a $1.7 billion market liquidation—mirrors previous consolidation phases that preceded rallies. The pattern's apex approaches, and a decisive close above or below its boundaries will dictate DOGE's trajectory for months ahead.

On-chain data from Santiment highlights renewed whale activity: addresses holding 100 million to 1 billion DOGE added 2 billion coins in two days, bringing their collective stash to 29.16 billion. This accumulation coincides with growing speculation around a potential spot ETF, further fueling bullish sentiment.

Dogecoin Gains Momentum with First US ETF Launch and Regulatory Tailwinds

Rex-Osprey's launch of the first US ETF tracking Dogecoin (DOJE) marks a watershed moment for meme coins, providing institutional-grade exposure to retail and professional investors alike. The SEC's streamlined crypto ETF rules further amplify bullish sentiment across the altcoin sector.

Despite recent liquidations that pressured DOGE prices, the coin shows signs of recovery as capital rotates from large-cap assets into meme tokens with newly legitimized investment vehicles. The $0.255-$0.260 resistance band now serves as a critical technical threshold, with a breakout potentially propelling DOGE toward last week's $0.280 level.

Is DOGE a good investment?

Based on current technical and fundamental analysis, DOGE presents a high-risk, high-reward investment opportunity. The cryptocurrency shows conflicting signals: while technical indicators suggest consolidation below key resistance levels, fundamental factors including whale accumulation, ETF speculation, and regulatory developments provide strong bullish catalysts.

| Metric | Current Value | Implication |

|---|---|---|

| Price | $0.23356 | Below 20-day MA, bearish short-term |

| MACD Histogram | +0.007448 | Potential bullish momentum building |

| Bollinger Band Position | Lower half | Consolidation phase, needs breakout |

| Whale Activity | 2B DOGE accumulated | Strong institutional interest |

| ETF Speculation | Growing | Potential major catalyst |

Investors should monitor the $0.215898 support level and $0.295817 resistance for directional cues. The combination of technical consolidation and strong fundamentals suggests potential for significant movement once either level is decisively broken.